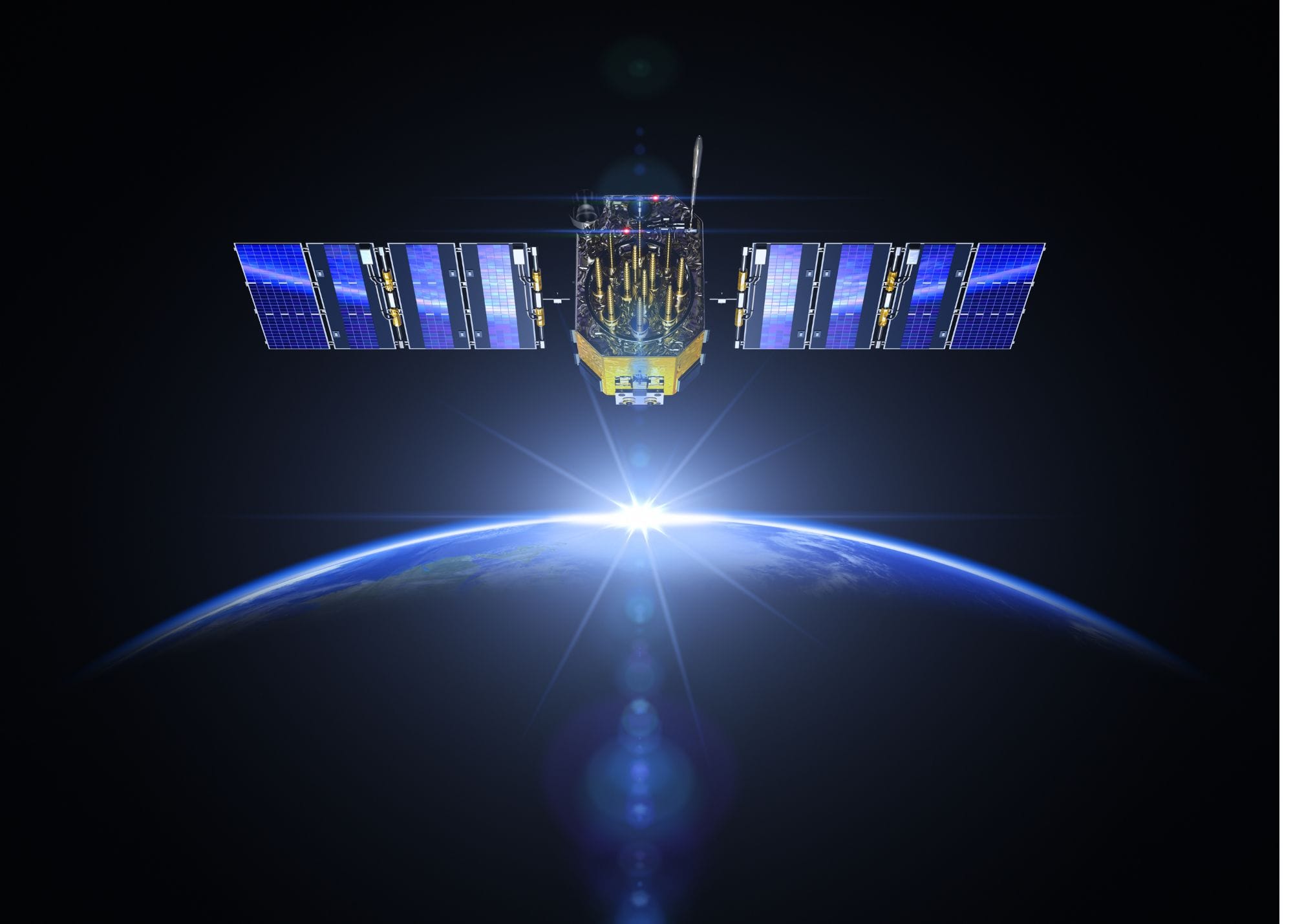

Spain’s Kreios Space has raised €8 million led by the NATO Innovation Fund—its first deal in Spain—to commercialise an “air-breathing” electric thruster that could keep satellites flying just a few hundred kilometres above Earth for years. That altitude—Very-Low Earth Orbit—changes the economics of imaging and direct-to-device links, and it plays directly into Europe’s industrial-policy ambitions.

Table of Contents

ToggleA quiet but strategic move

On 17–18 September, the NATO Innovation Fund (NIF) led an €8 million seed round in Kreios Space, a Vigo-based start-up developing air-breathing electric propulsion (ABEP). Berlin’s JOIN Capital co-led; Grow Venture Partners, XesGalicia (the Xunta de Galicia’s investment arm), and Tasivia also joined. It’s NIF’s first investment in Spain and a rare, explicit bet on Very-Low Earth Orbit (VLEO) hardware.

NIF is a €1bn venture vehicle backed by 24 NATO allies to push deep-tech with defence and resilience applications. Earlier allocations have signalled a preference for European supply-chain depth across domains from space to robotics. The Kreios deal extends that logic directly into orbital infrastructure.

Why VLEO, and why now

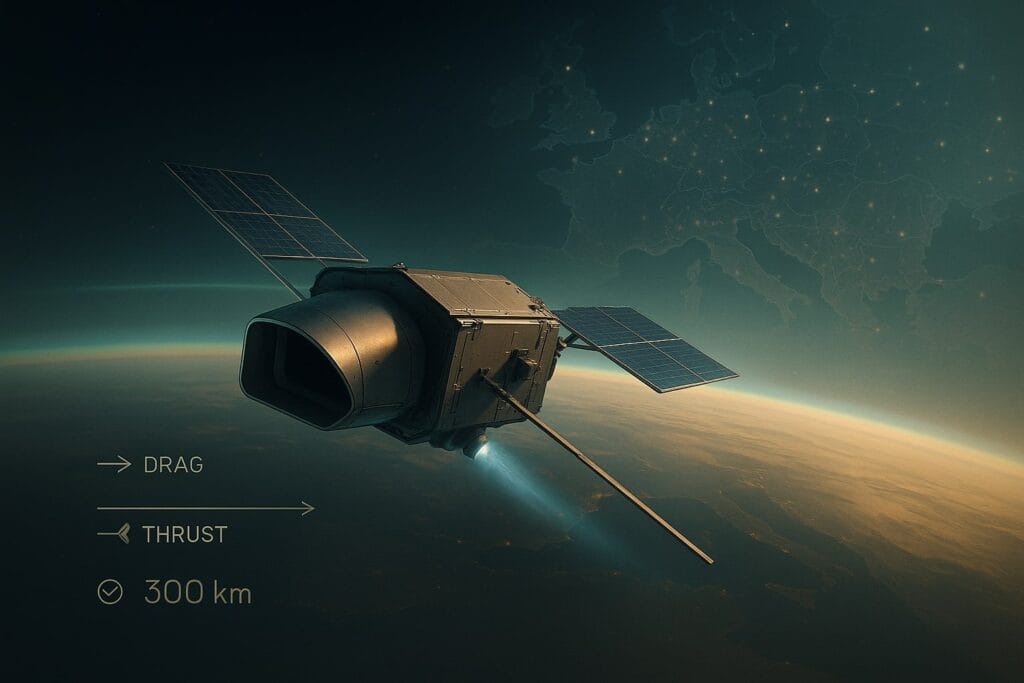

VLEO sits roughly 100–450 km above Earth (most commonly 250–350 km), well below conventional LEO shells. Closer orbits mean sharper imagery for the same optics, lower radiation exposure than higher LEO, easier end-of-life disposal thanks to natural drag, and—crucially for direct-to-device (NTN/3GPP) experiments—cleaner link budgets: halve the range and you gain ~6 dB in free-space path loss. Those physics translate into smaller ground hardware and new sovereign network options.

The catch is drag. Below ~400 km, satellites need near-continuous thrust to counter atmospheric braking. Europe proved pieces of the puzzle already: ESA’s GOCE flew as low as ~224–255 km by continuously throttling 1–20 mN of ion thrust; JAXA’s SLATS (Tsubame) pushed the floor to a Guinness-certified 167.4 km, exposing how materials and control systems behave in the thermosphere. But both relied on finite onboard propellant.

The “air-breathing” unlock

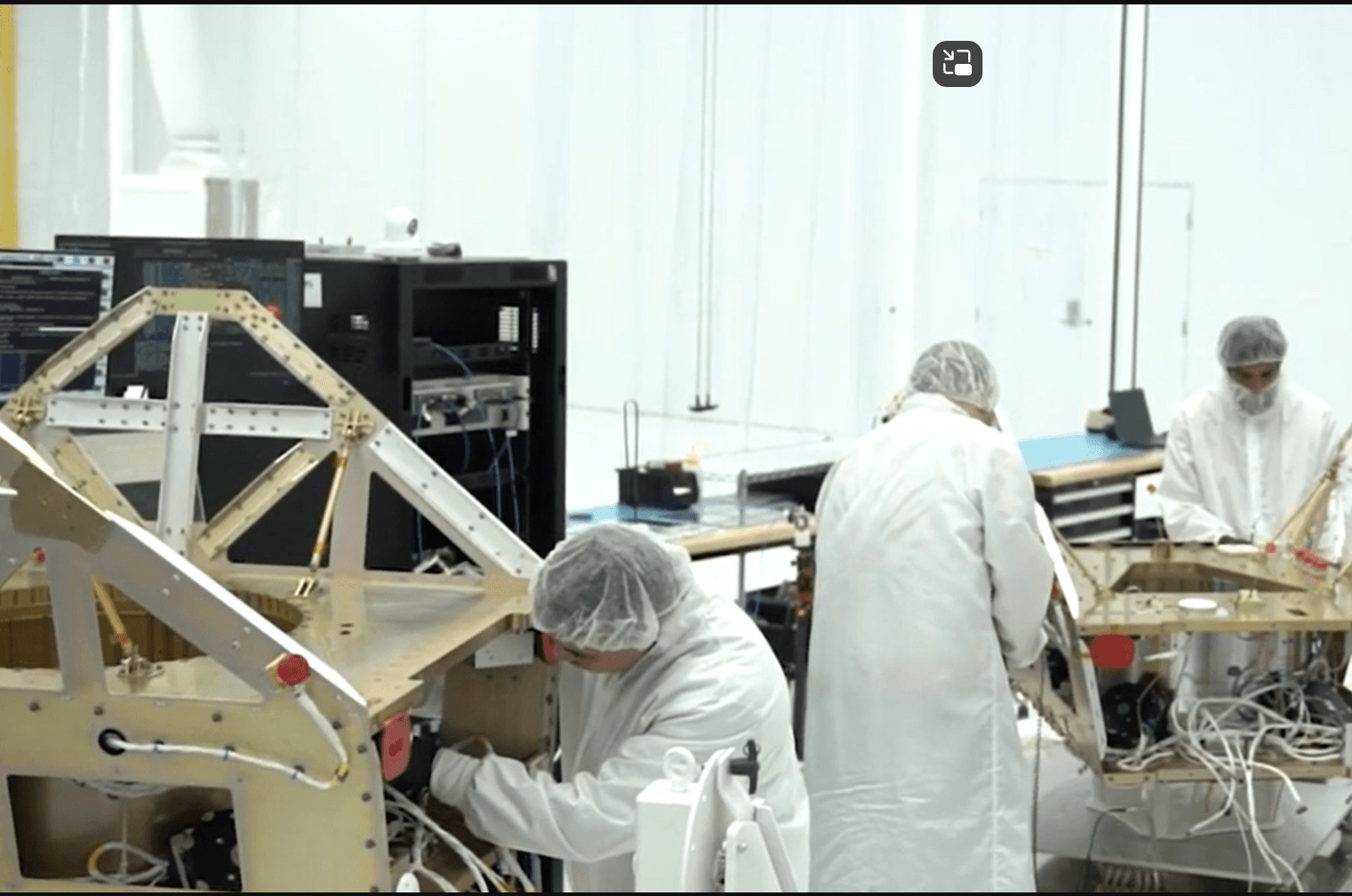

ABEP aims to remove the propellant bottleneck. An intake scoops residual molecules (mainly O/N2), an electric thruster ionises and accelerates them, and solar arrays provide power—turning drag into sustenance. ESA’s lab team fired a proof-of-concept in 2018, showing a path to satellites that “inhale” enough propellant to hold altitude. Kreios is effectively racing to take that lab milestone to orbit, at commercial scale.

Kreios describes its system as using “air and solar power—no onboard fuel tanks required”—a bold claim that, if validated, would allow multi-year operations in VLEO. The seed capital will fund first demonstration satellites, the pivotal step from ground tests to continuous, in-orbit drag compensation.

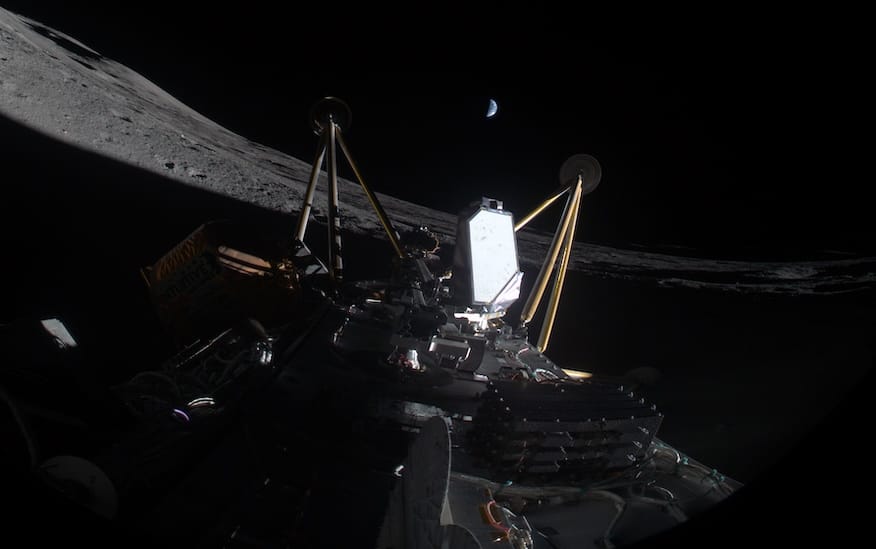

Europe’s VLEO stack is quietly forming

Just two days before the Kreios news, Redwire and Thales Alenia Space highlighted progress on ESA’s Skimsat—a VLEO smallsat tech-demo where electric propulsion is central. Taken together, Skimsat (a public R&D spine) and Kreios (a propulsion specialist) look like complementary pieces of a Europe-native VLEO industrial base. Expect more programmes to plug into that stack as ministries explore sovereign sensing and direct-to-device modes that don’t depend on non-European primes.

Use-cases (and economics) that actually change in VLEO

Sharper pixels without bigger telescopes. Ground-sample distance scales roughly with altitude; fly at ~300 km instead of ~600 km and, other factors equal, you can about double resolution. For defence and civil monitoring, that’s a cheaper route to premium imagery than building larger optics—and it comes with shorter revisit if you exploit drag-enabled plane changes.

Direct-to-device and tactical links. Every 2× reduction in slant-range yields ~6 dB link-budget relief—a meaningful margin for handhelds and IoT. VLEO’s geometry also trims latency and can ease terminal cert burdens by shrinking required antenna aperture. For European NTN experiments tied to 3GPP releases, that’s a material lever.

Cleaner deorbit by default. High drag speeds disposal, addressing regulators’ push for quicker post-mission re-entry and reducing collision risk in busy shells—another policy synergy for Brussels and national space offices.

Radiation and parts. Lower altitudes mean lower total ionising dose than many LEO regimes, which can relax component hardening (and cost) if thermal and atomic-oxygen effects are managed.

What Kreios still has to prove

Intake efficiency and thrust margin. To “hover” at ~200–300 km you must consistently produce thrust that exceeds drag with margin for manoeuvres. ESA’s GOCE numbers (1–20 mN continuously) are a benchmark for how tight those margins run; ABEP must achieve that without a xenon tank.

Power budget and arrays. ABEP trades propellant mass for power draw. High-efficiency arrays help, but power spikes during geomagnetic activity will test reserves and thermal design. (ESA’s 2018 ABEP announcement underscored the dependence on intake/ionisation efficiency.)

Materials and atomic oxygen. SLATS documented how atomic oxygen erodes surfaces at super-low altitudes. Kreios will need coatings and aerodynamics that survive that environment while maintaining intake performance.

Flight heritage. The company closed a €2.3m pre-seed in 2024 to build out its ABEP engine; the new round is about putting hardware in space. Until an actual on-orbit demonstration shows months of closed-loop, air-breathing station-keeping, ABEP remains a high-beta proposition—albeit one with clear strategic upside.

The sovereignty angle

This is not just a propulsion story; it’s an industrial policy story. Europe’s dependence on non-European primes in key LEO constellations has sharpened calls for “strategic autonomy”. NIF’s mandate—€1bn across 24 allies to push deep-tech with defence and resilience applications—provides the capital spine. Pair that with ESA’s Skimsat and national funds like XesGalicia and you can sketch a pipeline from lab research → seed propulsion → sovereign VLEO missions. That pipeline would deliver capabilities—high-grade imaging, secure D2D, rapid-tasking ISR—that European institutions can procure domestically.

Competitive landscape

ABEP has been a European research goal for years (ESA’s 2018 demo; EU-funded consortia), but no company has yet proven long-duration, autonomous, air-breathing flight. If Kreios succeeds, the moat won’t just be the thruster—it will be the operational dataset: months of real-world intake/ionisation/drag compensation telemetry in VLEO. That data would be hard to replicate and directly valuable to insurers, regulators and constellation operators tuning models for flight dynamics and materials life.

What to watch next (12–24 months)

- Demo timeline and target altitude. Look for a first mission profile—altitude bands, expected thrust margins, power headroom and planned station-keeping modes. (The seed round explicitly funds those first satellites.)

- Propulsion endurance curves. Evidence of months-long intake/ionisation stability under varying atmospheric density will be more important than a single “first light” burn.

- ESA integration points. Any ties to Skimsat (or successor demos) would accelerate standards around VLEO operations and payload interfaces.

- Procurement signals. Watch for European Commission or national procurement pilots that carve out VLEO-specific sensing or D2D trials—small money, high signalling power.

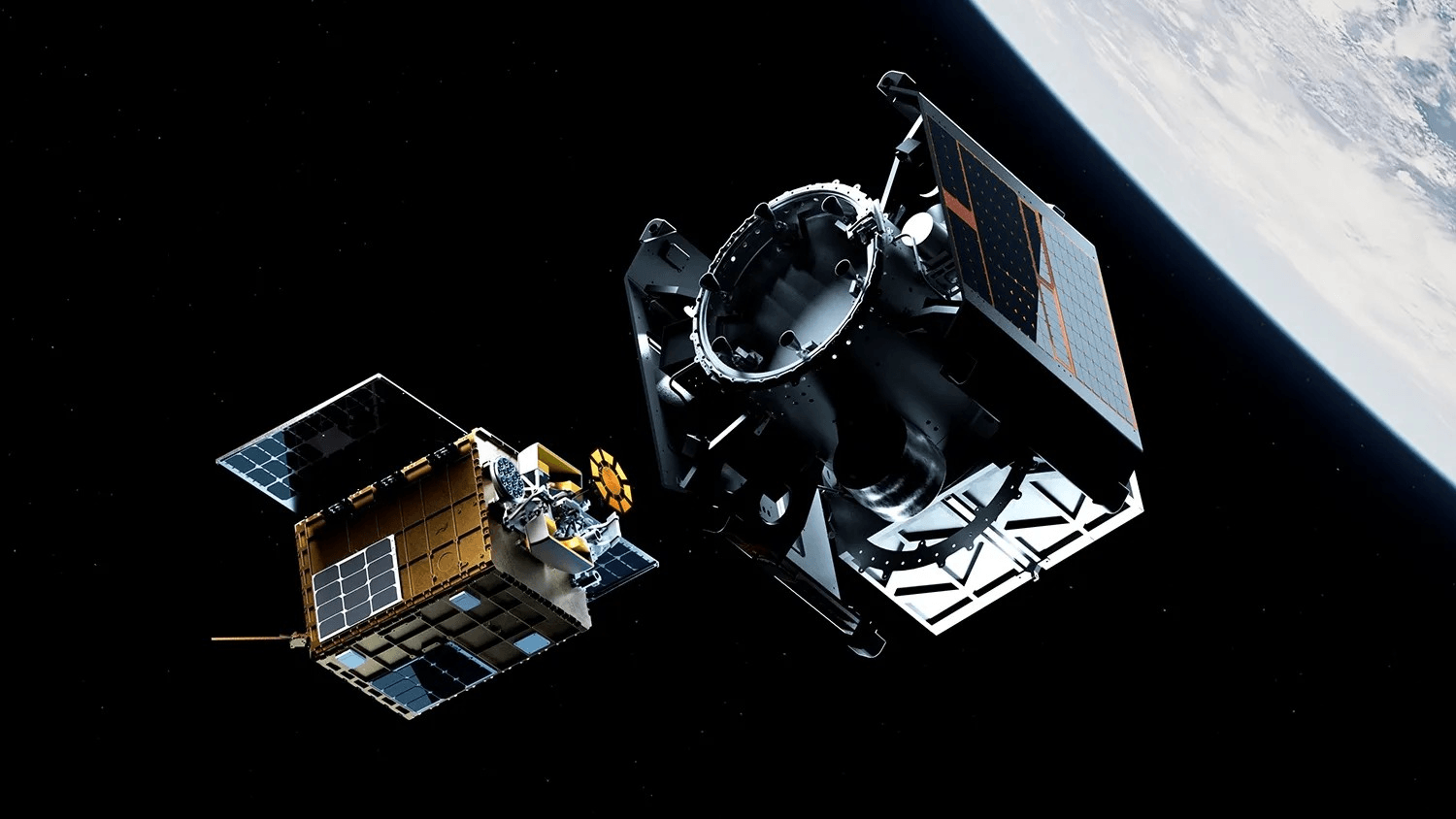

- Follow-on capital. If VLEO looks real, expect specialised investors in arrays, coatings and rendezvous robotics to show up—completing the VLEO stack.

Bottom line

Kreios’s seed round is small in absolute terms, but strategically loud. If ABEP works as advertised, VLEO could shift from a research cul-de-sac to a sovereign capability class—one that gives Europe sharper eyes, tighter links, and cleaner disposal, all on European hardware. That explains why a defence-oriented public VC would make Spain its first stop for space—and why rivals will now speed up their own plans around the lowest viable orbits.