A Tokyo startup choosing an Indian rocket for a sensitive rendezvous-and-inspection mission says as much about cost and cadence as it does about geopolitics. With India liberalising space investment and industrialising launch, payloads that need bespoke orbits — not mass rideshares — are starting to look south to Sriharikota.

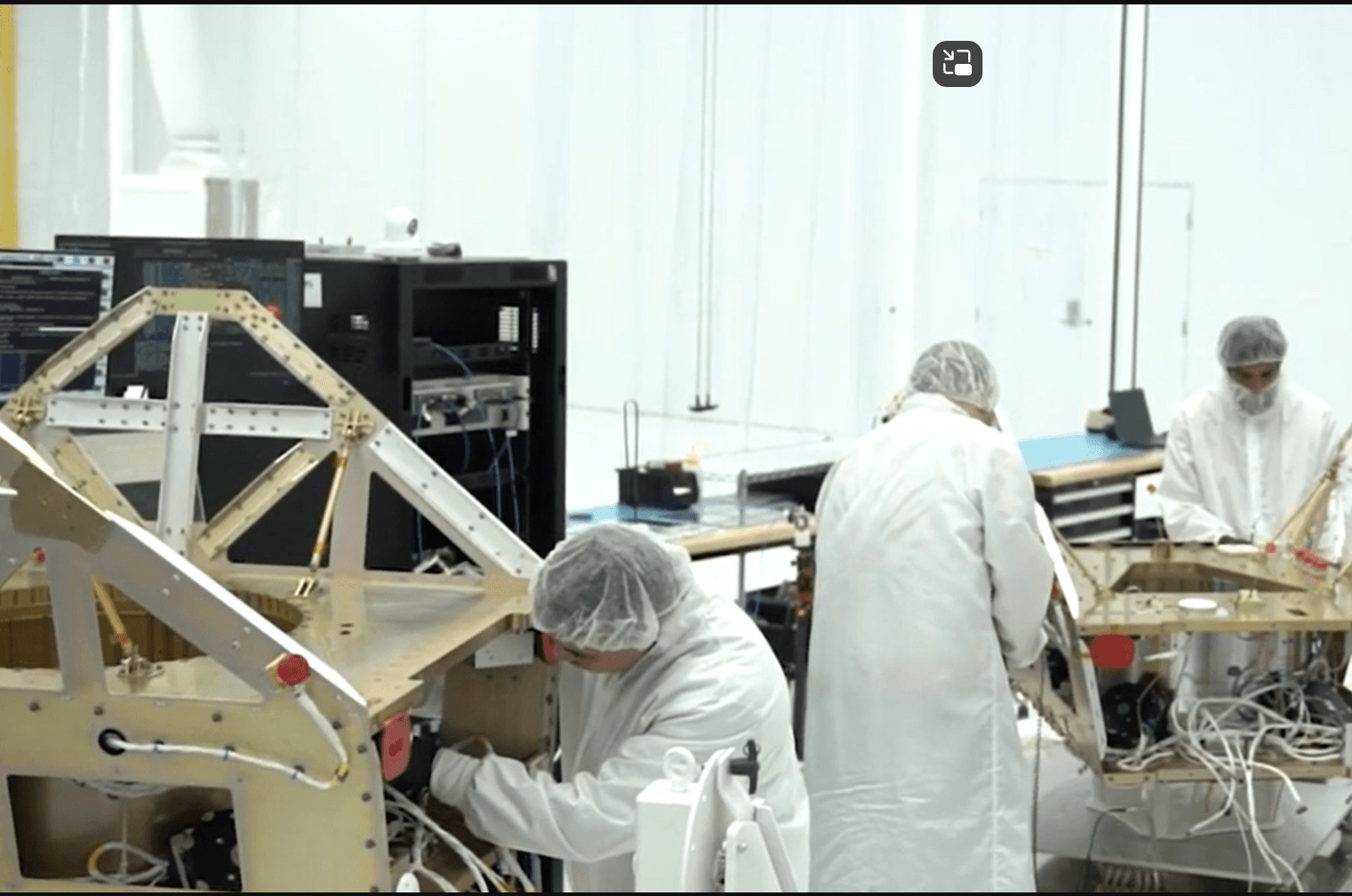

On September 11, 2025, Astroscale said it has signed a launch agreement with NewSpace India Limited (NSIL) to fly its ISSA-J1 in-situ space situational awareness mission on a PSLV from Satish Dhawan Space Centre in spring 2027. The company framed the decision after “evaluations of more than ten launch service providers,” citing technical capability, track record and cost; it also noted this is the first time a Japanese entity has procured a dedicated PSLV launch.

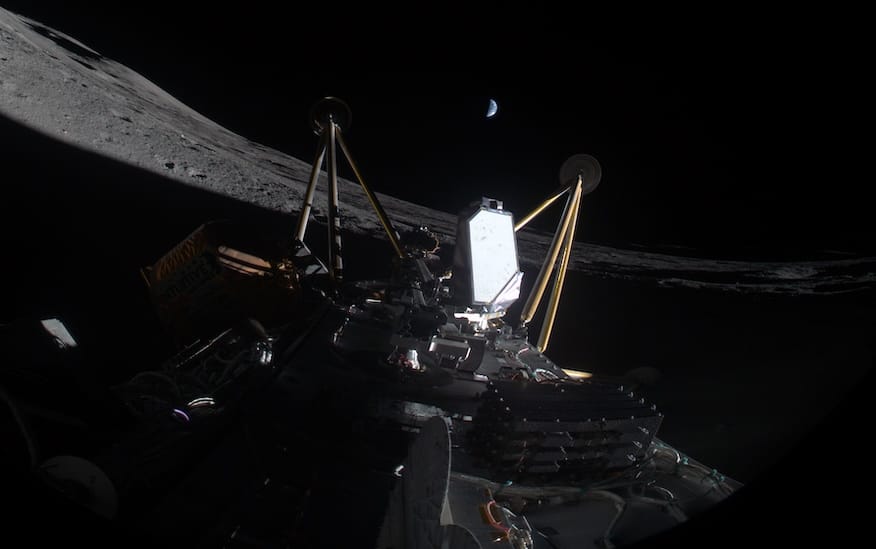

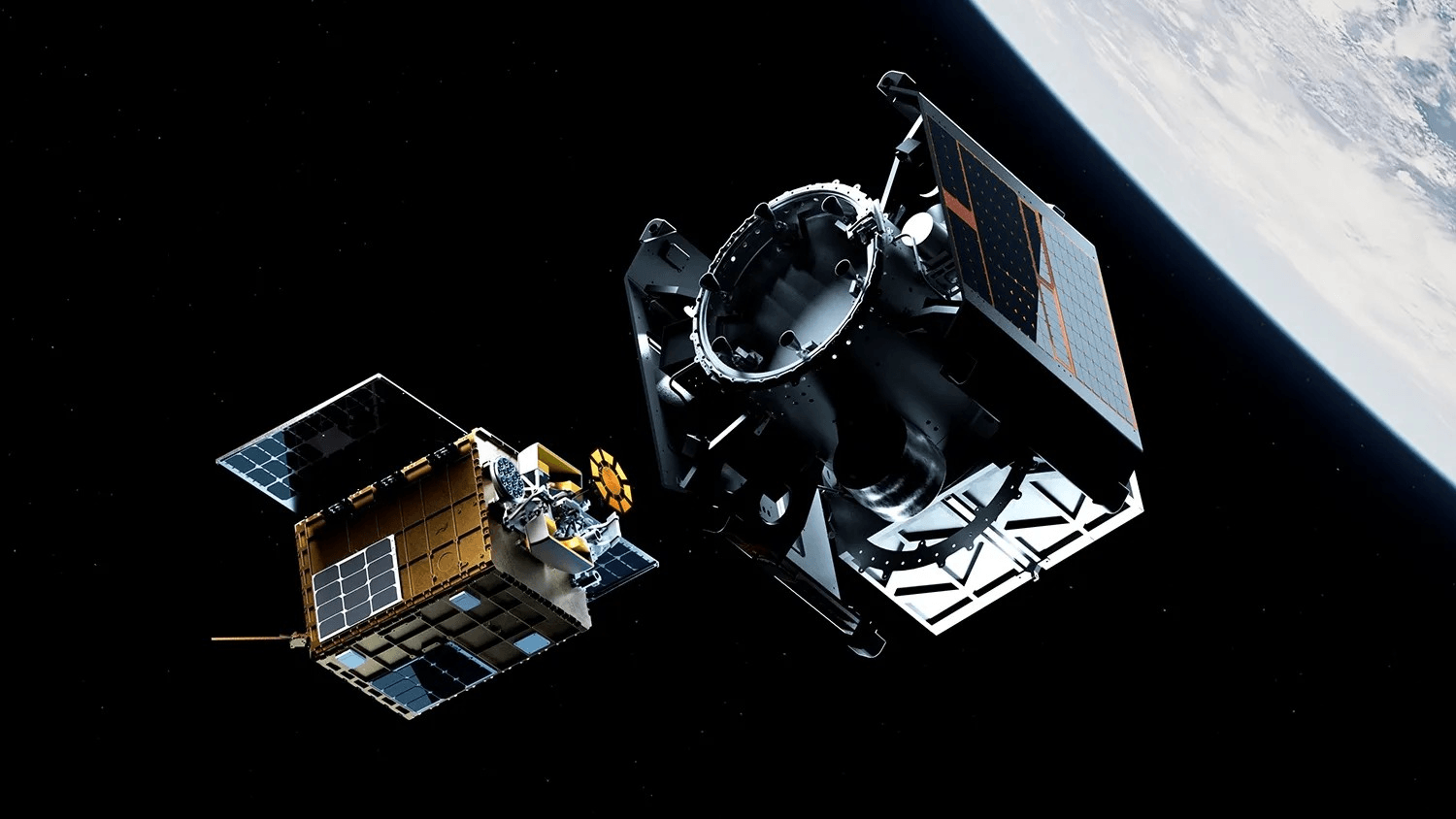

For a firm whose business is rendezvous, proximity operations and inspection (RPO/ISSA), the choice is strategic. ISSA-J1 will approach and diagnose two large pieces of satellite debris in orbit — a data-gathering precursor to more complex removal and servicing campaigns the company wants to monetise later in the decade. Program documentation pegs the project to Japan’s SBIR scheme and targets completion by March 2028, implying roughly a year of on-orbit operations after launch.

Table of Contents

ToggleWhy an Indian rocket — and why now

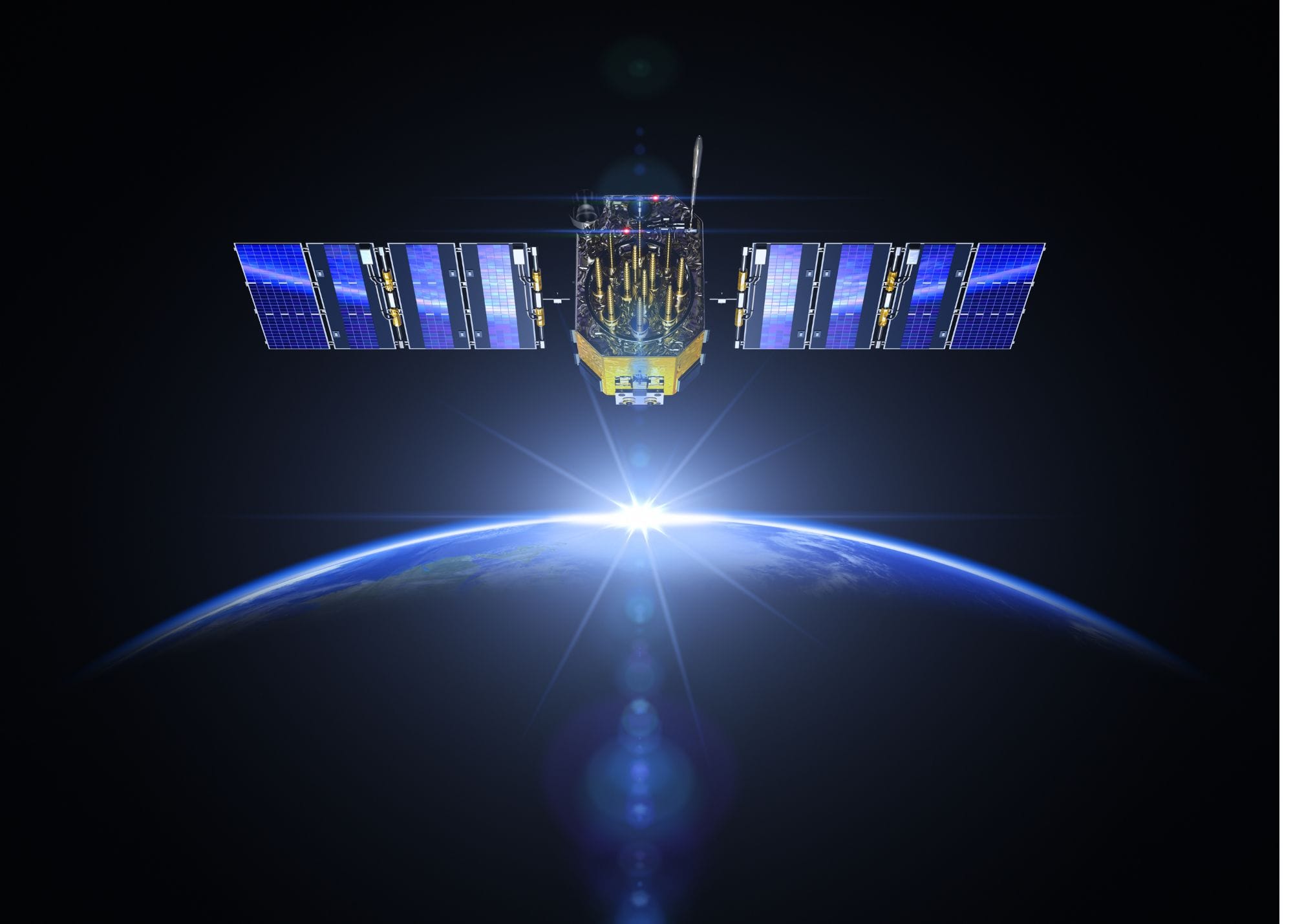

India’s PSLV has become a reliable, geometry-friendly workhorse for Sun-synchronous and other LEO missions that need specific planes, local-time nodes and altitude profiles — all hard to lock down on rideshares where the primary customer sets the orbit. Independent launch tallies put PSLV at ~63 missions with ~59 successes (≈94% success rate), a record marred by a rare failure in May 2025 but otherwise consistent over three decades.

Crucially, the move lands in a week when India doubled down on commercialisation: a multi-agency technology transfer giving HAL the rights to manufacture and operate SSLV at scale — India’s 100th such transfer — underscores the state’s push to industrialise small-launch capacity alongside PSLV.

Two structural reforms also change the procurement math for foreign customers:

- NSIL’s remit: as ISRO’s commercial arm, NSIL now produces PSLV through an industry consortium (GOCO model) and markets dedicated and rideshare opportunities, streamlining sales and integration for international payloads.

- FDI liberalisation (2024): India opened the door to automatic foreign investment up to 74% in satellite manufacturing and 49% in launch vehicles, with higher stakes by approval — easing JV structures and local supply-chain builds that often accompany sensitive missions.

Set against that backdrop, Astroscale’s call looks less like a one-off and more like a regional re-wiring of the space-safety supply chain: a Japanese operator, a Japanese government-funded demo, and an Indian launcher operating in a liberalised capital regime.

The mission case: inspection before removal

ISSA-J1 is designed to close the data gap on derelict satellites and upper stages, which do not broadcast GPS or telemetry and can have unknown mass properties and tumble states. The mission extends Astroscale’s RPO heritage — from ELSA-d to Japan’s ADRAS-J inspection of a real H-IIA upper stage — toward a repeatable “inspect-before-touch” service tier that de-risks later removal or refuelling. Program milestones cite SBIR funding up to US$80 million, Phase II in 2024, and a march to Phase III completion in 2028.

The macro need is uncontroversial. ESA’s 2025 Space Environment Report estimates ~40,000 tracked objects in orbit today, only ~11,000 of which are active spacecraft; the rest are spent stages and debris — with hundreds of thousands of smaller fragments below cataloguing thresholds. Inspection-grade imagery and dynamics data feed both conjunction risk models and grapple-point design, improving safety for any subsequent servicing.

Dedicated beats rideshare for RPO

A debris-inspection profile wants things rideshare rarely guarantees:

- Exact orbital plane and LTAN to choreograph RPO windows;

- Altitude targeting to minimise Δv for approach;

- Clean manifesting for unusual deploy sequences, sensor checkouts and extended commissioning.

A dedicated PSLV gives Astroscale control over insertion geometry and timeline, at a price point that — post-Trade-Control paperwork — can be competitive with Western small-launchers and more predictable than waiting for a convenient rideshare. In its announcement, Astroscale explicitly weighed track record and cost across >10 providers before choosing NSIL.

Follow the ecosystem money

Astroscale is not only buying a launch. In March 2025, it signed MoUs with India’s Bellatrix Aerospace (propulsion) and Digantara (space-traffic data/services), plus a local rep arrangement with MEMCO — a build-and-buy posture that mirrors how defence primes enter new markets.

For India, this is validation of policy. In two years the country has:

- liberalised FDI in satellites and launch,

- consolidated commercial sales via NSIL, and

- begun tech-transferring a small-launcher (SSLV) to a public-listed aerospace champion for mass production.

That policy stack is what draws non-recurring customers with non-standard orbit needs — exactly the kind of missions India struggled to capture a decade ago.

Competitive context: Europe’s precedent and the reliability story

Europe already voted with its feet when ESA’s Proba-3 — a high-precision, formation-flying science mission — launched on PSLV in 2024, partly to avoid Ariane 6 delays and post-Soyuz gaps. Space agencies do not entrust formation-flying coronagraphs to rockets they consider unreliable; Proba-3’s choice helped normalise PSLV as a mission-critical launcher for Western payloads.

To be sure, May 2025 brought a rare PSLV failure — a reminder that no rocket is bullet-proof — but independent datasets still place PSLV’s lifetime success rate around the mid-90s, comparable to peers in its class. For inspection missions where insertion geometry is the real constraint, that trade can pencil.

What it means for the debris economy

The inspection-first model addresses a market where risk-priced insurance, operator SLAs and regulatory norms are still catching up:

- Insurers and underwriters can price on-orbit triage once imagery and dynamics of a failed bus exist — potentially reducing loss ratios compared with write-offs and uncontrolled re-entries.

- Operators can factor post-failure options (inspect, re-orbit, refuel) into mission design if inspection data is timely.

- Regulators (ESA, FCC, national agencies) are tightening post-mission disposal standards; an inspection layer makes compliance auditable.

Astroscale’s pipeline aligns: the firm recently unveiled REFLEX-J, a refuelling demonstrator, signalling a progression from look → touch → service across missions and geographies.

The unanswered questions

Three things to watch between now and 2027:

- Target disclosure and geometry

ISSA-J1 will inspect two large debris objects; the identities, orbits and approach profiles will determine Δv budgets, sensor requirements and contact risk. Expect details only when operational security allows. - Industrial cadence

NSIL’s ability to schedule a bespoke PSLV amidst India’s civil and strategic manifest — while HAL ramps SSLV — will be a test of the country’s commercial tempo. The policy groundwork is there; execution now moves to factory floors. - Data rights and market design

Who owns and accesses inspection datasets? If Astroscale can sell sanitized imagery and state estimates to insurers, regulators and other operators, an ISSA marketplace emerges, lowering unit costs for all. (Astroscale already markets ISSA as a service tier.)

Bottom line

A Japanese debris-tech champion picking an Indian rocket is not just a procurement curiosity. It reflects a converging Asian playbook: Japanese public funding de-risking frontier operations, Indian industrial policy compressing cost and lead-times, and a private operator threading both to sell safety into a cluttered LEO. If Astroscale hits its spring 2027 window and delivers actionable inspections, expect more RPO-centric missions to follow the same southward trajectory.