Table of Contents

ToggleAmazon Enters the Satellite Broadband Arena

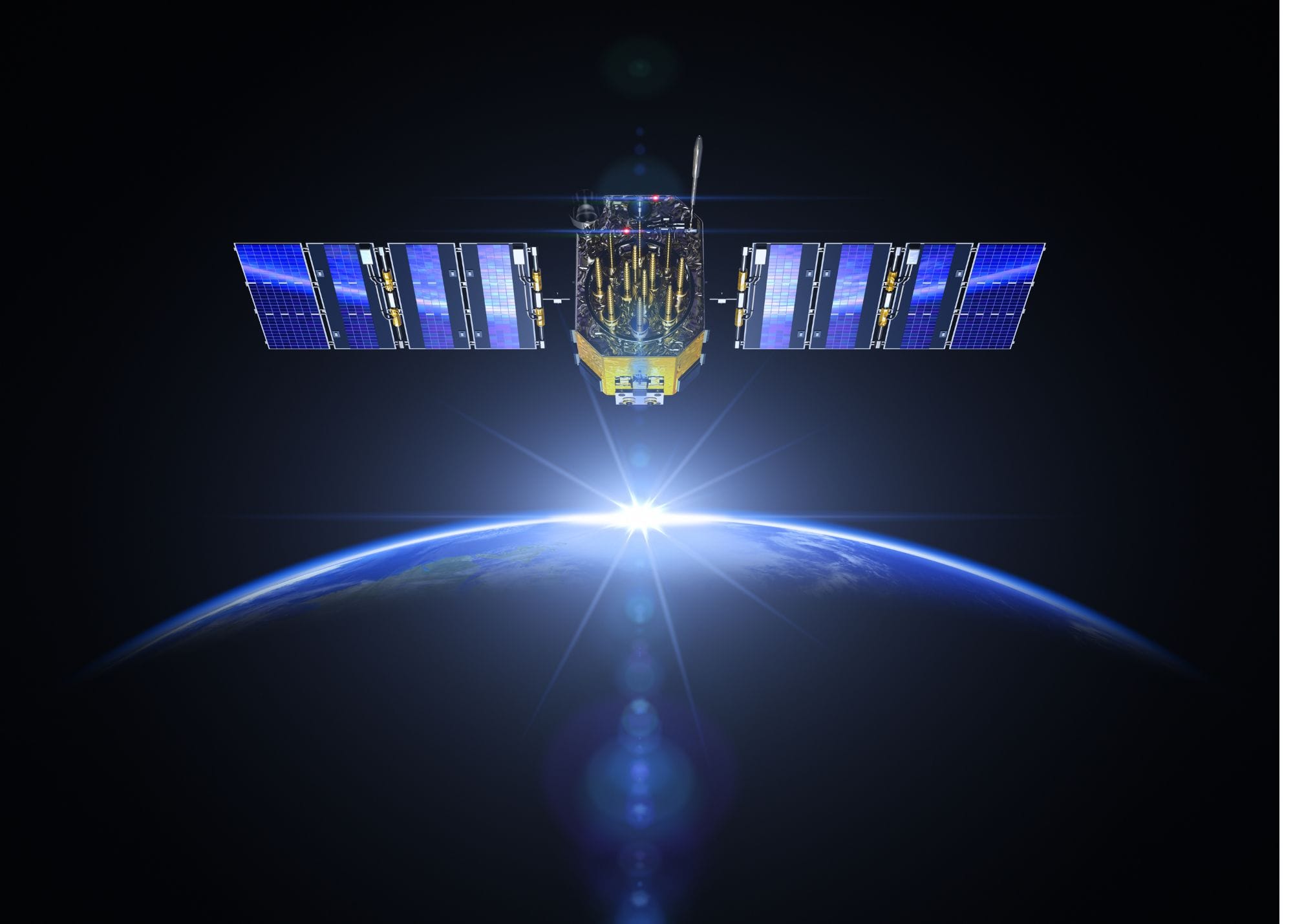

On April 9, 2025, an Atlas V rocket is scheduled to lift off from Florida carrying the first production satellites of Amazon’s Project Kuiper – a planned constellation of over 3,200 low-Earth-orbit broadband satellites. For Amazon, a company synonymous with e-commerce and cloud computing, this launch is more than just a rocket ride; it’s a bold foray into space-based internet. The context is unprecedented: a tech giant known for next-day deliveries and web services is now aiming to beam high-speed internet down from orbit to virtually any location on Earth. Amazon’s long-anticipated entrance into the satellite broadband market signals how fiercely competitive and important this arena has become. The company has committed at least $10 billion to Project Kuiper’s development – a hefty investment underscoring the significance of the opportunity it sees in connecting the unconnected and competing with established players like SpaceX’s Starlink.

The significance of Amazon’s move goes beyond expanding its own empire; it’s emblematic of a new era in which private companies are building critical global infrastructure once left to governments. By launching a “megaconstellation” of satellites, Amazon aims to deliver fast, reliable internet to remote villages, ships at sea, disaster zones, and developing regions that fiber-optic cables don’t reach. In doing so, it is directly challenging SpaceX’s Starlink, currently the frontrunner in low-Earth-orbit broadband. This high-stakes push into orbit reflects both the opportunity (billions of potential new internet users) and the necessity – Amazon doesn’t want to be left behind in a future where connectivity extends to every corner of the globe from space. As one Amazon executive framed it ahead of the launch: “No matter how the mission unfolds, this is just the start of our journey” – a journey that could redefine Amazon’s role in global connectivity.

Starlink vs. Kuiper: A New Rivalry in Orbit

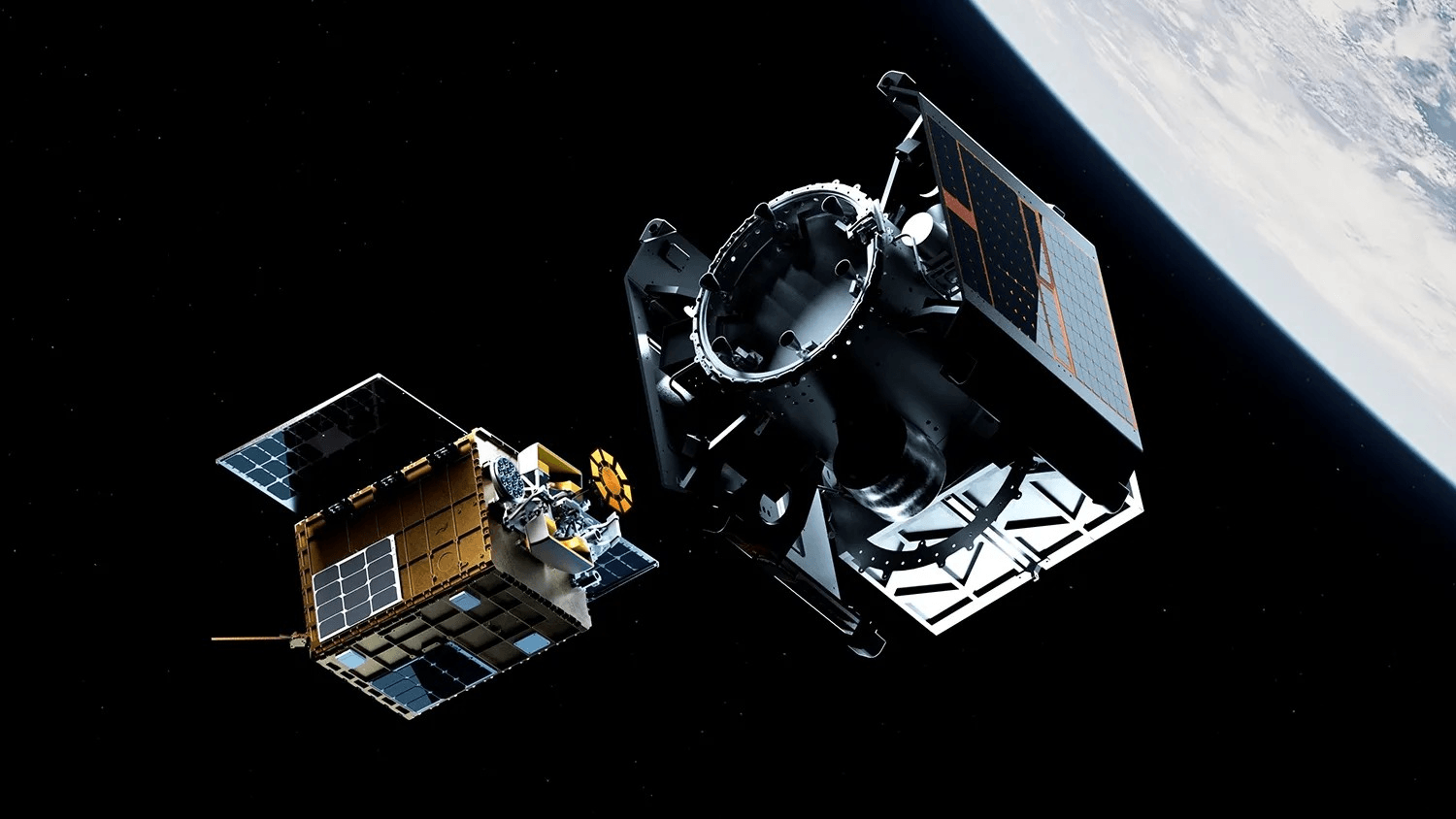

Amazon’s Project Kuiper inevitably draws comparisons to SpaceX’s Starlink, which pioneered the modern satellite internet boom. Starlink, launched by Elon Musk’s SpaceX, has been deploying satellites since 2019 and already has “more than 7,000 satellites in orbit” and around 5 million subscribers worldwide. In contrast, Amazon is just now launching its first batch of operational satellites. However, Amazon is moving quickly to catch up. It has secured an astonishing 80+ launches over the next few years to build out its constellation, enlisting an array of launch providers – United Launch Alliance (ULA), Arianespace, Blue Origin (Jeff Bezos’s other space venture), and even SpaceX itself. This underscores the scale of Amazon’s ambitions: the company is effectively buying an airlift to space on any available rocket to close the gap with Starlink.

How do Project Kuiper and Starlink stack up? Here’s a quick look at the two mega-constellations:

- Constellation Size & Altitude: Amazon’s FCC license authorizes 3,236 Kuiper satellites in low Earth orbit, arranged in 98 orbital planes at altitudes of roughly 590 km, 610 km, and 630 km. SpaceX’s Starlink first-generation network envisions about 4,408 satellites at ~550 km (with plans for up to 12,000, and even 30,000 in a Gen2 proposal). Starlink has 7,000+ already in orbit, whereas Kuiper is just beginning with 27 satellites on this first launch. Both constellations operate in similar orbits (few hundred kilometers up), which is key to delivering low latency.

- Launch Cadence: SpaceX enjoys a major advantage with its rapid launch capability – reusing Falcon 9 rockets to loft dozens of Starlink satellites in one go, often multiple times per month. This has enabled Starlink’s head start. Amazon, lacking a rocket of its own ready for service (Bezos’s Blue Origin New Glenn is still in testing), has purchased rides: 9 Atlas V missions, 38 Vulcan Centaur (ULA’s next-gen rocket), 18 Ariane 6, and up to 15 New Glenn launches, plus 3 Falcon 9 flights booked from its rival SpaceX. ULA’s Atlas V can carry 27 Kuiper sats at a time, while the forthcoming Vulcan will take 45 per launch. This multi-provider strategy is ambitious, but also introduces complexity – Amazon will be juggling schedules across different rockets and manufacturers. The company will need a relentless launch tempo to meet regulatory milestones (more on those soon). In 2025 alone, Amazon hopes to conduct several launches; one ULA executive noted they have “quite a few Kuiper Atlas [V launches] planned this year, as well as Kuiper Vulcans”.

- Network Capabilities: Both Starlink and Kuiper promise high-speed, low-latency broadband anywhere on Earth, but their technical approaches have nuances. Starlink’s current user terminals (the pizza-sized dishes many RV owners and rural users now recognize) typically deliver 50–200 Mbps downlink speeds in real-world use. Amazon has revealed three customer terminal designs: a portable 7-inch-square antenna for 100 Mbps, a standard home terminal targeting ~400 Mbps, and a larger enterprise dish capable of 1 Gbps. This means Kuiper is aiming for comparable or higher throughput per user, especially for businesses, and potentially at lower hardware cost. Amazon says it expects to produce its standard terminals for under $400 each, a price point that could undercut Starlink’s $599 hardware (Amazon hasn’t announced monthly service pricing yet). In orbit, Amazon is equipping every Kuiper satellite with advanced optical inter-satellite links (laser links) to create a space mesh network, similar to Starlink’s latest generation. These laser links allow satellites to hand off data to one another in orbit, reducing the need for ground relay hops and extending coverage over oceans or remote areas. Amazon recently demonstrated 100 Gbps laser communications between prototype satellites, and boasts that its orbital laser network can route data about 30% faster than fiber optic cables over long distances. This could make Kuiper’s network extremely competitive for latency-sensitive applications (imagine stock trades or video calls being routed through space more quickly than through undersea cables). SpaceX, for its part, has also begun deploying laser links on Starlink satellites to similar effect – the technological race here is neck and neck, with both constellations pushing the envelope of satellite-to-satellite comms.

- Market Ambitions: Starlink has a first-mover advantage with 5 million users already signed up since its beta in 2020, capturing pent-up demand from rural consumers, RV travelers, airlines (in-flight Wi-Fi deals), and even military clients. Amazon is coming in fresh, but the market for global connectivity is vast. Project Kuiper is positioning itself as a viable alternative for consumers and governments who, until now, have had essentially one choice for LEO broadband. Amazon can leverage its massive customer base and ecosystem – for instance, one could envision Kuiper internet bundled with Amazon Prime or integrated with AWS cloud services for enterprise offerings. The company also has a global retail presence which might help in distributing the terminals and services. Notably, Amazon is already hiring aggressively for Project Kuiper (it leads the Seattle-area space industry in job openings, surpassing even Blue Origin), indicating its long-term commitment. In terms of service rollout, Amazon projects that once it has about 578 satellites up (roughly 18% of the constellation), it can start limited service coverage. It aims to “begin delivering service to customers later this year” (2025), likely starting in regions with enough satellite density. That’s roughly parallel to Starlink’s trajectory, which began offering beta service after a few hundred satellites were launched. The big picture: Starlink and Kuiper both aim to ultimately bring many tens of millions of people online – a potential game-changer for communities with no fiber or reliable wireless today. But with that ambition comes intense competition, and a collision course of business strategies in space.

Under the Hood: Kuiper’s Satellite Design and AWS Integration

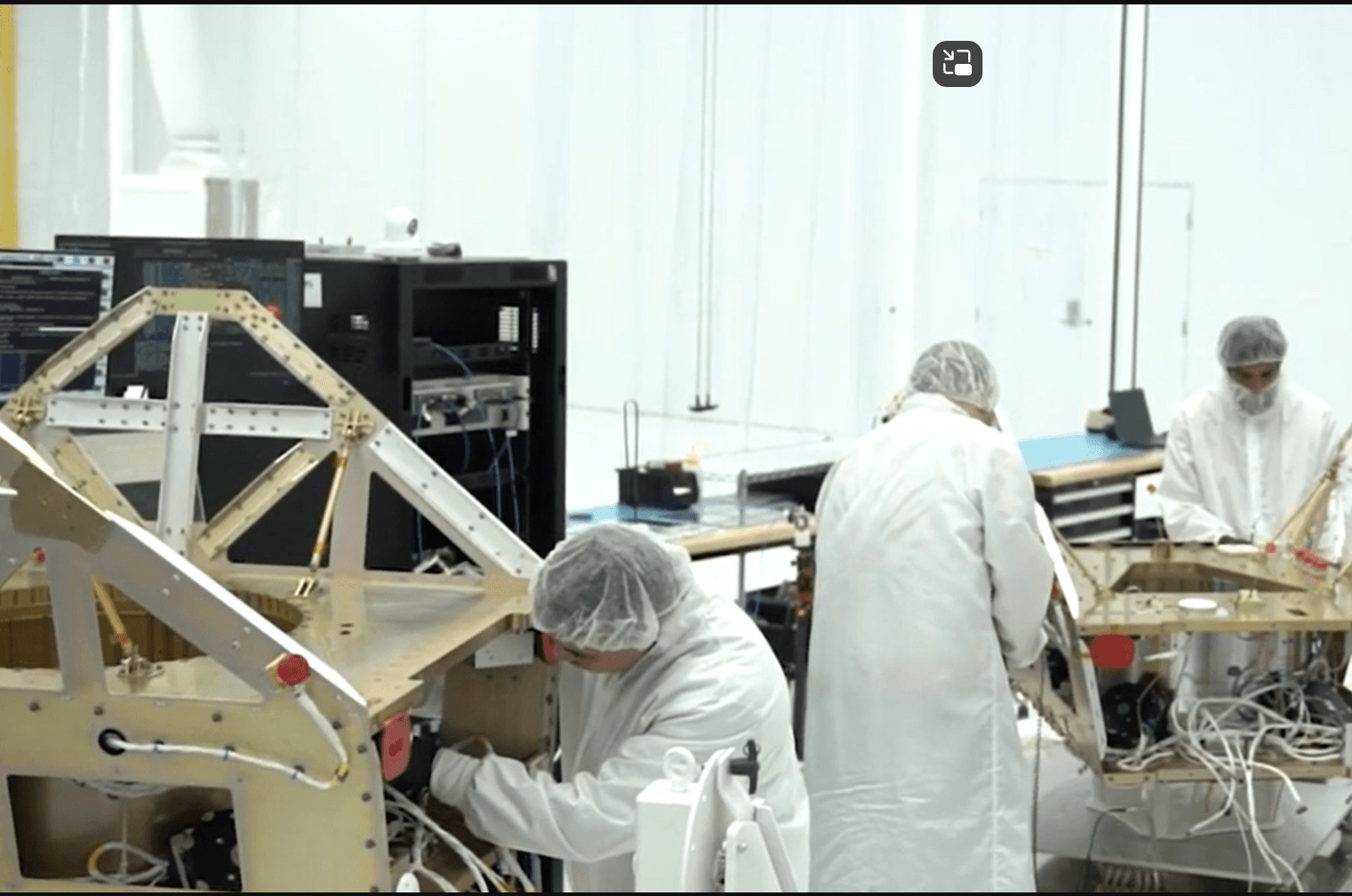

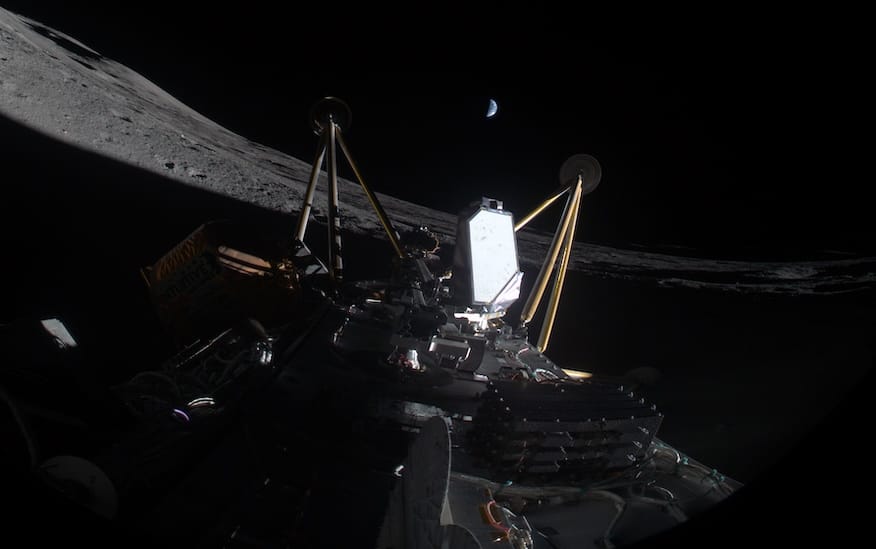

Behind the glossy promise of “internet from space” lies cutting-edge engineering. Amazon has been relatively secretive about Kuiper’s satellite hardware, but some details have emerged as the program moved from prototype to production. Each Kuiper satellite is a roughly refrigerator-sized, advanced communications node bristling with phased-array antennas and high-throughput radios. Amazon’s engineers spent years testing subsystems on the ground and with a pair of prototype satellites (launched in late 2023) before finalizing the design. Those prototypes validated key technologies – including the novel optical links – and even during that trial, Kuiper satellites managed to stream 4K video from orbit and complete an online purchase on Amazon.com (a cheeky but telling proof-of-concept that the system works).

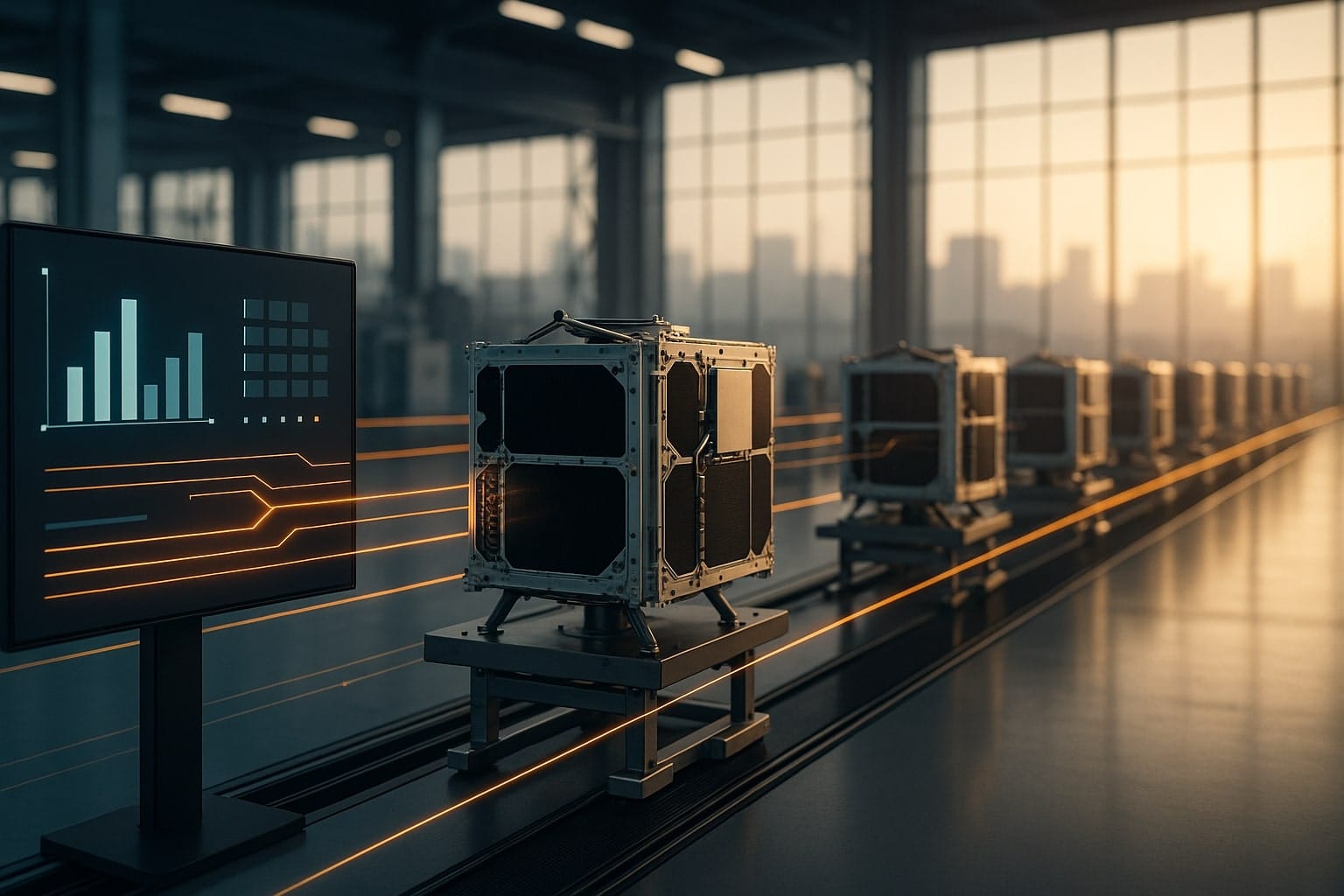

The production satellites launching now incorporate significant upgrades across all major systems compared to the trial models. “We have improved the performance of every system and sub-system on board, including phased array antennas, processors, solar arrays, propulsion systems, and optical inter-satellite links,” Amazon’s VP of Project Kuiper, Rajeev Badyal, said of the final design. This means each satellite is more powerful and efficient – capable of handling more user connections and data traffic, adjusting beams dynamically, and maintaining its orbit and orientation with precision. The inclusion of a propulsion system is critical: it allows Kuiper satellites to maneuver in space for collision avoidance and to de-orbit at end-of-life, a key aspect of mitigating space debris. (Starlink likewise uses ion thrusters for these purposes.) It’s worth noting that the first Kuiper launch’s payload – 27 satellites plus dispenser – is so heavy that it maxes out the Atlas V rocket’s lifting capability. In fact, this KA-01 mission is the heaviest payload Atlas V has ever orbited, underscoring how substantial each satellite is. By contrast, SpaceX can launch smaller batches of Starlink satellites largely because it designed both the satellites and launch process together; Amazon must pack satellites onto whichever rockets are available, hence the need to optimize each rocket load to full capacity.

One of Project Kuiper’s secret weapons is Amazon’s vast cloud infrastructure. In an era where hardware alone doesn’t win the race, integration with software and ground networks is paramount. Here, Amazon’s advantage is its AWS (Amazon Web Services) backbone, which the Kuiper network will directly leverage. The satellite constellation is designed to send user data to the nearest available ground gateway, which in turn plugs into Amazon’s fiber networks and AWS data centers. Because Kuiper can funnel traffic through AWS’s global infrastructure, it can reduce latency and deliver content more efficiently to end-users. As Amazon described, “Project Kuiper leverages AWS services and infrastructure to route data traffic, [so] we can reduce latency even further across our network.” In practice, this might mean that when a Kuiper user in a rural area requests a video or website, the data might securely traverse Amazon’s private network for much of its journey, popping out on the public internet close to its destination or origin server – a potentially faster path than the open internet. This deep integration of space and cloud is a distinguishing factor for Amazon: it’s not just launching satellites, it’s extending the AWS cloud to the skies.

Moreover, Amazon has built a 24/7 mission operations center in Redmond, Washington (where its satellite development is based) to manage the Kuiper fleet. Using automation and software, the company will handle tasks like satellite health monitoring, orbital maneuvers, and routing of data between satellites and ground stations. This is similar to SpaceX’s Starlink network operations but expect Amazon to tie in a lot of its cloud-based AI and network management tools to optimize the system. The satellites will essentially act as an extension of Amazon’s terrestrial networks. There’s also synergy here for AWS’s government and enterprise customers: AWS could offer satellite connectivity as a service (for IoT devices, remote offices, or even military field units), bundling Kuiper links with cloud compute and storage. In 2022, AWS and Kuiper even jointly announced they would support the Pentagon’s “Hybrid Space Architecture” project, looking at ways to blend commercial satellite comms (like Kuiper) into defense networks. All of this suggests that Kuiper isn’t a standalone venture; it’s being woven into Amazon’s larger ecosystem. While the average consumer will just see a Wi-Fi signal from a little Amazon dish, behind the scenes an enormous amount of cloud intelligence and infrastructure will be choreographing that connection.

From Backyard Dishes to Global Coverage: User Terminals and Ground Infrastructure

To actually deliver internet into users’ homes and devices, ground equipment is just as important as orbiting satellites. Amazon’s approach to user terminals shows a clear strategy of accessibility and versatility. The company has unveiled three types of customer antennas that will connect to the Kuiper satellites:

The variety of terminal sizes suggests Amazon is targeting a broad market: from individual consumers (the tiny 7-inch unit could be mounted on an RV or carried to a campsite) to typical households (the mid-size terminal for home internet) and even enterprise or government customers (the large high-bandwidth dish). The plug-and-play design of these terminals is emphasized – they are essentially flat, electronic-steered antennas with no moving parts, which you can install yourself and point skyward to connect. Amazon has an edge here in its experience with consumer devices and logistics. It can leverage its factories and suppliers (perhaps the same that produce Echo devices or Fire TVs) to crank out satellite dishes at scale, and use its global retail/distribution network to ship and service them. In 2023 when Amazon first showed off the prototypes, observers noted the smallest Kuiper antenna was “the smallest, lowest-cost satellite dish” of its kind, a feat of engineering to cram phased-array tech into such a small form.

On the ground infrastructure side beyond the customer premises, Amazon will need a network of gateway stations that link the satellite constellation to the Internet backbone. While Amazon hasn’t publicly detailed all its gateway locations, it’s known that they’ll be deploying Earth station antennas that connect Kuiper satellites to terrestrial fiber. Given Amazon’s AWS data center presence across the globe, it wouldn’t be surprising if many Kuiper gateways are co-located at or near AWS facilities. This means when a Kuiper satellite passes over, say, an AWS region data center, it can downlink terabytes of user data it gathered and uplink content to beam to users, all through a high-capacity ground antenna tied directly into Amazon’s network. By comparison, Starlink has built dozens of gateways often near internet exchange points and even partnered with Google to site some at Google data centers. Amazon can follow a similar model, using its own cloud sites as landing pads for sky traffic.

The user experience Amazon envisions is straightforward: Customers would install the Kuiper app, set up their flat dish (on a rooftop, or a backyard tripod, or even on a boat) with a clear view of the sky, and connect to Amazon’s satellite network to get internet service. Amazon has hinted that it may subsidize customer hardware (much like mobile carriers subsidize phones) to spur adoption. And given Amazon’s penchant for ecosystem, one can imagine future integration where your Kuiper satellite link works seamlessly with Alexa devices or Amazon Fire streaming (perhaps caching Prime Video content efficiently via satellite multicast). While those are speculative touches, what’s clear is that Amazon is focusing on ease of use and cost to make its service compelling. After all, Starlink, despite its success, has faced criticism for its equipment cost and sometimes patchy availability when cells get crowded. If Amazon can deliver comparable speeds at a lower price – and especially if it uses its retail might to bundle services – it could rapidly carve out a share of the market.

Regulatory, Geopolitical, and Environmental Stakes

The satellite internet gold rush is not happening in a vacuum. There are significant regulatory and geopolitical implications as mega-constellations like Starlink and Kuiper take shape, and Amazon’s project is at the center of many of these issues.

First, Amazon is under regulatory pressure to deploy its constellation on a tight timeline. The U.S. Federal Communications Commission (FCC) granted Amazon approval for Project Kuiper on the condition that it launches half of its satellites (1,618) by July 30, 2026, and the full 3,236 by July 30, 2029. If Amazon fails to meet these milestones, it could lose rights to the spectrum and orbital slots it fought hard to secure – the FCC could reduce its authorized fleet to whatever is deployed by the deadline. This ticking clock has been cited as “a looming deadline” and a major challenge for Kuiper. By some estimates, Amazon would need to average 95+ satellites launched per month to hit the 2026 target – a blistering pace that even SpaceX has not consistently maintained. It is widely expected that Amazon might seek an extension if delays occur (the FCC can grant waivers), but any slippage cuts into Amazon’s credibility and could give SpaceX an even greater lead. Thus, the company’s aggressive launch bookings and ramp-up in 2025–2026 are directly motivated by this regulatory mandate. Internationally, Amazon will also need to coordinate spectrum usage and obtain licenses in each country it wants to serve. This can be a complex dance: Starlink, for example, has had to get approvals or forge partnerships in dozens of nations (and has been barred or limited in some markets due to local telecom regulations). Amazon’s global commerce presence might help it navigate these waters, but governments will surely weigh how another foreign-operated satellite network fits into their national communications strategies.

Geopolitically, the rise of competing mega-constellations has states taking notice – sometimes embracing them, sometimes warily eyeing their influence. Starlink’s prominent role in the Ukraine war is a case in point: when Russia’s invasion disrupted ground communications, Starlink terminals provided critical connectivity to Ukrainian forces and civilians. That episode demonstrated the strategic importance of LEO satellite internet, but also raised questions about the power held by a private company (SpaceX) and its mercurial owner in controlling that lifeline. In the aftermath, allied governments have been keen on ensuring they have alternatives and aren’t solely reliant on Starlink. Amazon’s Kuiper could be one such alternative. For instance, officials in Taiwan – which worries about a potential conflict with China that could cut undersea internet cables – have reportedly been in talks with Amazon to tap Project Kuiper as a backup communications system. “In case of submarine cable failure, call Jeff Bezos,” quipped one report, highlighting the interest in Kuiper as a strategic reserve for connectivity. Likewise, the U.S. and European governments have generally welcomed Amazon’s entry, since a second major player in LEO broadband could bolster resilience and competition. The European Union, in fact, is moving ahead with its own planned constellation (dubbed IRIS²) for secure government and commercial communications by 2027, partly to ensure Europe isn’t left behind in this arena. And China has announced plans for a massive state-backed LEO constellation as well, seeing the provision of global internet service as both an economic opportunity and a matter of national security. In this context, Amazon’s Project Kuiper is not just a commercial venture; it is becoming a piece in a larger geopolitical puzzle over who provides and controls the world’s digital infrastructure from space.

Then there are the environmental and operational challenges of crowding Earth’s orbit with thousands more satellites. Astronomers and space environmentalists have voiced concerns ever since Starlink’s first trains of satellites streaked across the night sky. With Project Kuiper adding its fleet, those concerns are only amplified. Amazon, to its credit, has proactively taken steps to mitigate some issues. The Kuiper satellites are coated with a special “dielectric mirror” film that scatters sunlight to make them less reflective. This is aimed at reducing their brightness when sunlit, thereby minimizing interference with ground-based telescopes and the naked-eye view of stars. Starlink had to learn this through trial and error – after astronomers complained about bright Starlink flares, SpaceX experimented with darker coatings and sunshades. Amazon was able to bake a solution into its design from the start, and early indications (from the prototype launches) suggest Kuiper sats will indeed be fainter. Still, when thousands of new objects roam the heavens, some impact on the night sky is inevitable. Scientists worry about the cumulative effect: already, “the rise of mega constellations threatens to clutter the night sky, disrupt the work of astronomers, and create space debris that harms people on Earth and in space alike”. Essentially, every new satellite increases the risk of collisions and adds to the brightness noise in long-exposure images of the cosmos.

Space debris is a particularly thorny issue. Amazon has stated that its satellites will have onboard propulsion to de-orbit themselves at end of mission, hopefully burning up in the atmosphere rather than lingering as junk. They will also be programmed to perform automatic collision avoidance using U.S. Space Force tracking data, similar to Starlink’s system. However, once thousands of objects are whizzing around at 17,000 mph, the margin for error narrows. There have been a few close calls and maneuvering incidents with Starlink satellites and other spacecraft; adding Kuiper satellites increases the traffic in already-popular altitude bands (~600 km). The nightmare scenario is the Kessler Syndrome – a chain reaction of collisions producing debris that in turn causes more collisions, potentially rendering low orbits unusable. While we are far from that tipping point, each mega-constellation accelerates the trend toward a more crowded sky. Regulators and researchers are now actively discussing new rules – for example, whether to mandate brighter object mitigation, or to require satellite makers to adhere to even stricter debris mitigation (like de-orbit within 5 years of mission end, which Kuiper plans to do). The U.S. GAO (Government Accountability Office) even suggested that environmental reviews might be necessary for large satellite fleets, considering their impact on astronomy and the atmosphere. Space is vast, but the usable orbits are a finite resource; Amazon’s constellation, alongside SpaceX’s, OneWeb’s, and others, will test how well the industry and world can coordinate in orbit to avoid chaos. On the flip side, Amazon’s involvement might also bring more resources and attention to solving these issues – for instance, Amazon could contribute to technologies for debris removal or improved satellite tracking as part of its corporate responsibility.

Looking Ahead: High Hopes and New Challenges

As Amazon’s Project Kuiper moves from concept to reality with this first launch, the satellite broadband landscape is poised for profound change. The coming months will be crucial. Amazon will test these initial satellites in orbit, validate that its network can deliver on the promised speeds and latency, and ramp up mass-production at its new satellite manufacturing facility. By late 2025, we could see early service trials for customers – perhaps remote Alaskan villages or pilots with enterprise clients – as Amazon begins to light up its network. If all goes well, by 2026 Kuiper will be rolling out connectivity to ordinary consumers in multiple countries, directly challenging Starlink’s market with an alternative source of space-based Wi-Fi.

For users around the world, this competition could be very good news. More players in satellite internet may drive prices down and push performance up. We might see innovative plans – imagine an Amazon Prime bundle that includes a certain amount of Kuiper internet service, or integration where data delivered via Kuiper for AWS cloud customers has ultra-low latency benefits. SpaceX won’t be standing still either: it’s deploying upgraded Starlink satellites (and banking on its Starship rocket to deploy its next-gen satellites by the hundreds), and it’s pursuing new markets like direct-to-cellphone service. The race to connect the unconnected is heating up, with tens of billions of dollars being poured into orbit. Ultimately, if both Starlink and Kuiper succeed, the once far-fetched idea of global broadband coverage – every person on the planet having access to fast internet, whether on a mountaintop, a desert, or a disaster zone – could become reality within this decade.

However, these rosy possibilities come with many unanswered questions. Will Amazon’s late start mean it perpetually plays catch-up to SpaceX, or can its operational savvy and deep pockets let it leapfrog in technology or service offerings? Can the two mega-constellations coexist without interfering with each other’s signals or hogging spectrum (technical coordination is ongoing to prevent cross-talk)? And might we see orbit overcrowding prompt stricter regulation or international diplomacy – perhaps even caps on the number of active satellites or requirements for shared networks? The megaconstellation era is a new chapter for policymakers as much as for engineers.

What’s clear is that Amazon’s first Kuiper launch is a watershed moment. It represents the opening salvo in a new front of the Bezos-vs-Musk rivalry – not just a billionaire ego contest, but a battle of business models and technological prowess that could shape how humans communicate. It also marks the point where space infrastructure becomes a more normalized part of Big Tech’s domain. Just as cloud computing reshaped internet services over the past 15 years (with Amazon at the forefront), space-based computing and connectivity may reshape the next 15. Project Kuiper could eventually interlink with Amazon’s dreams in other domains – from autonomous drones to smart agriculture to Internet of Things devices in the most remote oilfields, all feeding data through the AWS cloud via satellite.

For now, all eyes are on that launch pad in Cape Canaveral. As the Atlas V roars to life and sends Amazon’s satellites skyward, it’s carrying with it not only the hardware for a new internet network, but also the lofty hopes of Amazon’s next frontier. From Jeff Bezos’s standpoint, it’s the culmination of years of quiet development – and the moment Amazon truly becomes a space company. For consumers and communities around the world, it could mean a future where broadband access is no longer bound by ground infrastructure. And for the industry, it’s a signal that the space internet revolution kicked off by Starlink is accelerating into a two-horse race. In the end, more competition in the heavens could translate to a more connected and innovative life on Earth – if we manage it wisely. Amazon’s Project Kuiper is now officially part of that story, launching into both the literal and figurative unknown, with tremendous potential orbiting just overhead.