On October 29, 2025 (PT), Saudi Arabia’s stc group signed a decade-long commercial agreement with AST SpaceMobile that includes a $175 million cash prepayment in 2025 and deployment across Saudi Arabia and selected Middle East and African markets. Services are targeted for Q4 2026, pending regulatory approvals.

Table of Contents

ToggleThe news, in plain terms

- Deal structure: stc commits to a 10-year commercial agreement for space-based cellular broadband, with a $175 million prepayment during 2025 for future services and a broader, undisclosed long-term revenue commitment.

- Footprint & timing: Initial rollout covers Saudi Arabia with expansion into select MENA markets; commercial service is anticipated in Q4 2026, subject to approvals from Saudi Arabia’s Communications, Space and Technology Commission (CST) and regulators across the operator’s footprint.

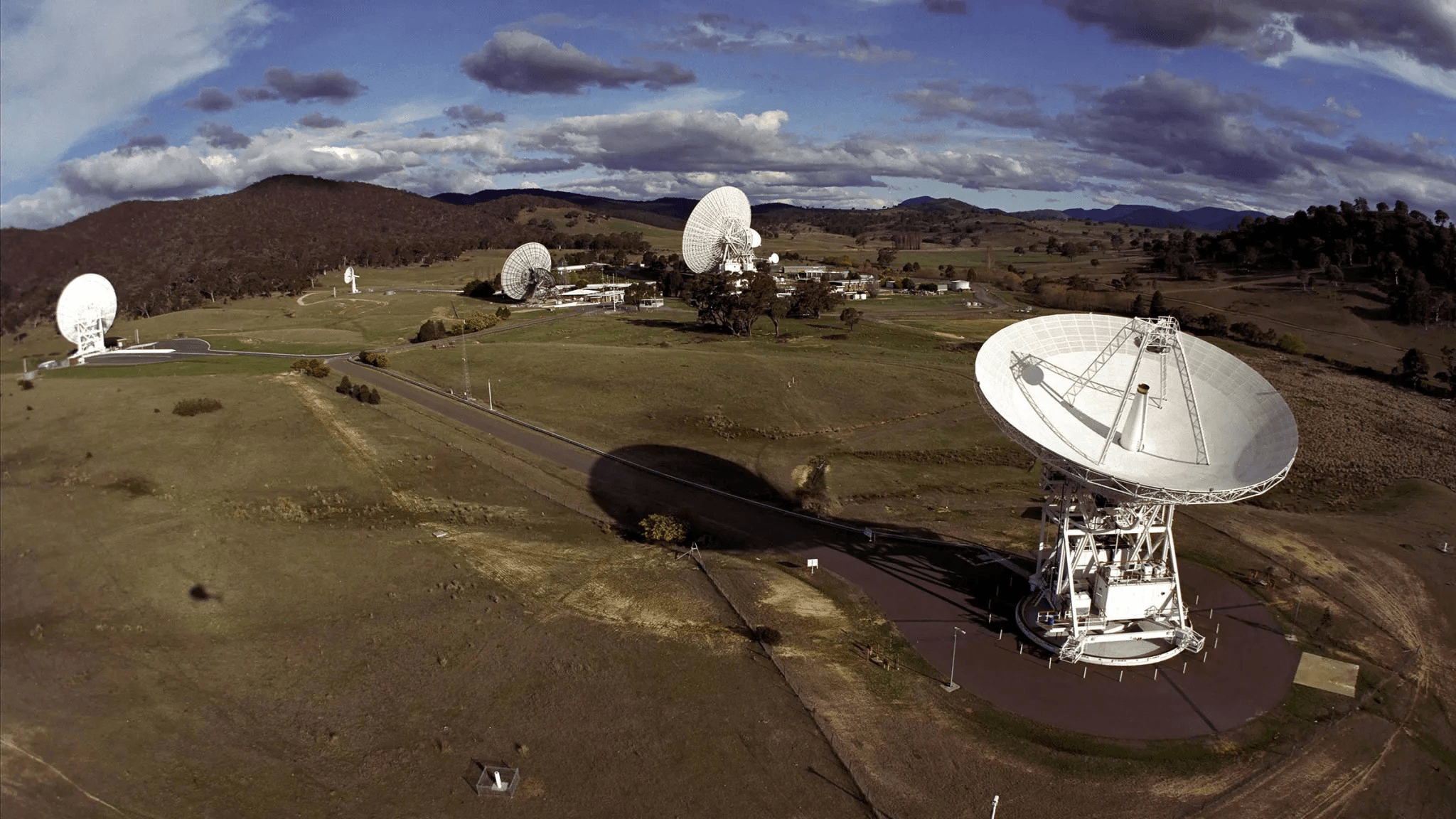

- Ground segment: AST will build three ground gateways in the Kingdom and a Network Operations Center (NOC) in Riyadh to operate and assure service quality.

- Operator disclosure: stc also notified the local market of the multi-year arrangement aimed at direct-to-device (D2D) services, underscoring the strategic nature of the partnership.

Why this matters for investors

Cash up front is different from a pilot. A prepaid commitment converts what is often a memorandum of intent into near-term liquidity—money committed before service starts. For AST SpaceMobile (ASTS), that can help finance manufacturing, launch, and ground infrastructure without relying exclusively on equity or high-cost debt. (Accounting note: cash may be received ahead of revenue recognition and recorded as a contract liability until service delivery; the signal for investors is the counterparty’s willingness to fund the build.)

Service-level credibility. The gateways + Riyadh NOC detail is not window dressing; it anchors service availability, latency, and lawful intercept/compliance in-country—features that large telcos and regulators look for before green-lighting mass-market plans. It is also a capital commitment that is hard to walk back, improving the deal’s stickiness.

A template for MENA. stc is the region’s bellwether. If early economics work (blended ARPU uplift, churn reduction in rural/remote segments, government connectivity programs), other MNOs in the Gulf, North Africa, and the Sahel could replicate the structure—especially the cash-backed prepayment—to secure capacity and local gateways.

How the D2D model works (and where stc fits)

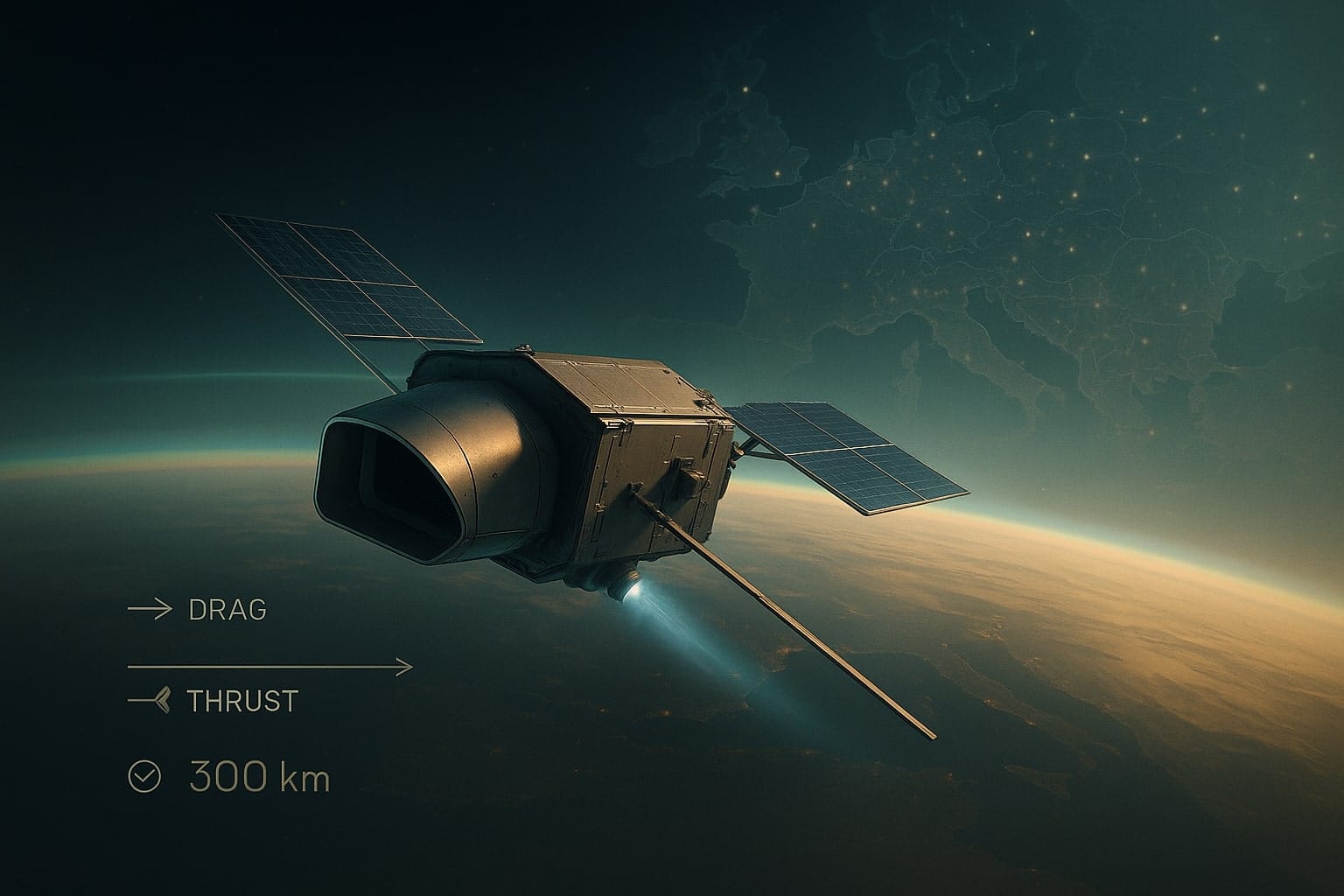

AST’s network aims to deliver 4G/5G broadband directly to unmodified smartphones—no special handset, app, or radio accessory—by using very large, phased-array satellites (“BlueBird”) that emulate a cell tower from low-Earth orbit. For stc, that means fewer coverage holes without the capex and permitting burden of terrestrial towers in deserts, mountains, or maritime zones. The announced plan explicitly targets 5G and LTE services to standard devices.

The partnership contemplates terrestrial–space integration: stc’s core network and spectrum, AST’s space layer, and local gateways for traffic anchoring, policy, and billing. For end-users, that should translate to “it just works” coverage at the edge of stc’s map—voice, messaging, and data—priced either as a premium add-on, a roaming-like pass, or bundled into higher-tier plans.

Timeline, milestones, and the build that has to happen

- 2025: stc’s $175 million prepayment scheduled for receipt during 2025 (per SEC filing). Watch for cash-flow disclosures and how management frames capex versus constellation ramp.

- 2025–2026: AST is preparing the next tranche of BlueBird launches (“Block 2”), with management telling investors it expects at least five launches by end-Q1 2026—a cadence that underpins the Q4 2026 service target in KSA.

- 2026: Regulatory approvals—especially CST licensing—and gateway readiness become the gating items for commercial switch-on in Q4 2026.

What a “cash-backed” D2D deal changes

- Financing risk: Prepayments de-risk near-term funding and can compress the weighted average cost of capital if they reduce equity issuance needs. (The specifics will depend on AST’s broader capex plan and other customer advances.)

- Capacity allocation: When operators pre-buy capacity or service levels, it sharpens AST’s constellation planning—orbital planes, ground-pass schedules, and beam allocation optimized for Saudi/MENA demand rather than purely global averages.

- Competitive signaling: A Tier-1 Gulf operator committing cash before service puts pressure on peers weighing their D2D options—whether to sign early with a provider, hold out for alternatives, or pursue hybrid models (e.g., backhaul, messaging-first).

The commercial questions stc (and peers) will test

- Price architecture: Does D2D land as a small monthly add-on (e.g., SAR-denominated bundle), a pay-per-day pass for remote work/travel, or a safety-of-life feature cross-subsidized by government programs? The press materials avoid price points, but gateway siting in KSA suggests stc intends mainstream scale—not a niche.

- Device and UX: The promise is no special software or device updates. If activation is as simple as a plan toggle, stc can drive adoption through family and enterprise bundles. Expect staged feature rollouts: voice/SMS reliability first, then higher-throughput data tiers by geography.

- Enterprise & public-sector: Oil & gas, logistics, Hajj/Umrah crowd-management corridors, coastal SAR, and national resilience use-cases are obvious early demand pools. A Riyadh NOC can also streamline lawful intercept and public-safety integration.

Risks and how to read them

- Regulatory pacing: CST and neighboring regulators must approve spectrum use, service models, and consumer disclosures. The Q4 2026 target is contingent on those approvals across a multi-country footprint—delays in one market may not block KSA go-live, but could slow regional revenue ramp.

- Manufacturing & launch cadence: AST’s constellation plan hinges on delivering and launching multiple BlueBirds on schedule. Management has guided to multiple launches by end-Q1 2026; investors should track factory throughput, launch manifests, and on-orbit performance KPIs.

- Service quality at scale: Early pilots prove feasibility; the test is millions of devices contending for beams, especially during festivals, coastal traffic peaks, or weather disruptions. Gateway/NOC telemetry—and stc’s customer-care tooling—will be decisive.

Strategic read-through: what this says about the D2D market

This is the first disclosed, cash-prepaid, decade-long D2D deal in MENA from a top-tier operator. The structure—prepay + local ground segment + regulatory pathway—looks exportable. If AST executes, it could set a pricing and contracting template for telcos from the Gulf to Africa: less about vanity pilots, more about booked demand that supports constellation capex.