On 24 September, NASA awarded Flagstaff-based Katalyst Space Technologies a $30 million contract to rendezvous with, capture and push the Neil Gehrels Swift Observatory into a higher orbit—buying the celebrated astrophysics mission more years of life. If successful in spring 2026, it will be the first time a commercial robot has captured a government satellite that wasn’t designed for servicing. The decision is about far more than saving a telescope: it rewrites how America buys, insures, regulates, and defends on-orbit capability.

Table of Contents

ToggleThe headline move: rapid procurement for a rapid problem

Swift—launched in 2004 without propulsion—has been slipping lower thanks to heightened solar activity that thickens the upper atmosphere. NASA opted to move “from concept to implementation in less than a year” by using a Phase III SBIR award, a procurement path that lets agencies sole-source follow-on work to an existing SBIR participant when it “derives from or extends” prior work. The goal: a quick orbit-boost demonstration that extends Swift’s science lifetime while proving a capability the U.S. increasingly needs.

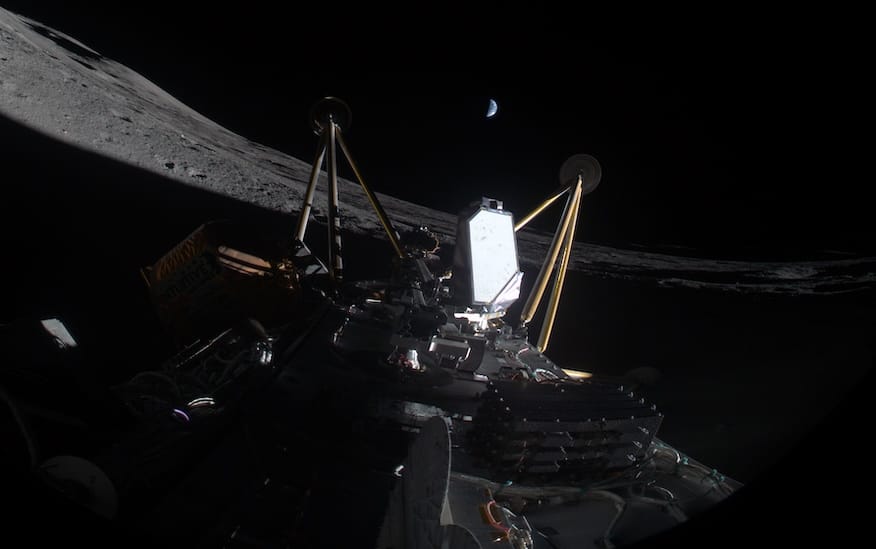

Reuters reporting adds the operational stakes. Swift sits roughly 585 km up and, by NASA’s estimate, had a ~90% chance of burning up by late 2026 without intervention. Katalyst plans to adapt its “Link” servicer (accelerated by its April acquisition of Atomos Space) and launch as early as May 2026. The clever bit: gripping small ground-handling flanges on Swift’s structure—metal rims never intended for docking—to push the observatory higher.

Why this matters beyond one telescope

This is a policy pivot. After NASA cancelled the multibillion-dollar OSAM-1 refuelling demo in 2024 over cost and schedule risk, the agency is testing a leaner model: procure a narrowly-scoped commercial service fast, prove value, and scale. That approach—quick SBIR Phase III awards for targeted, “doable” demonstrations—could seed a routine marketplace for life-extension and rescue missions across civil and national-security fleets.

There’s a strategic layer, too. The Pentagon has watched China rehearse close-proximity manoeuvres and grappling in orbit; demonstrating rapid, precise RPO (rendezvous and proximity operations) on a live, operational U.S. asset signals capability and confidence.

The engineering: how do you grab a satellite built to avoid you?

Unlike Hubble, Swift has no capture fixtures. Katalyst says its servicer will perform autonomous RPO and pinch those small flanges to secure a safe, load-bearing grip before firing thrusters for an orbit raise. It’s delicate work around aging instruments—Swift uses a Burst Alert Telescope, X-ray Telescope, and UV/Optical Telescope to localise and characterise gamma-ray bursts—so the capture system must minimise shock loads and plume impingement.

Swift’s own resilience helps: despite gyro issues in 2024, the team patched the flight software to operate in two-gyro mode and returned to science. In other words, the payload is worth saving.

The market signal: from “one-off demo” to a service you can buy

Katalyst’s bet is that responsive, lower-cost servicers—built on commercial avionics and electric propulsion—can be produced for “high single-digit to low double-digit millions” per unit, an order of magnitude below legacy spacecraft. If the Swift boost works, it validates a repeatable product: rapid-response orbit raises, gentle de-orbits, inspection, even emergency tows when satellites lose attitude control. That is a different business than the GEO life-extension niche pioneered by Northrop’s MEV; it’s a LEO servicing market with civil, defence and commercial customers.

The timing is favourable. After a bruising 2023 for space insurers, 2024 profitability improved—but underwriters still complain about thin data and rising technical risk. Demonstrations like Swift’s rescue generate the flight statistics actuaries need to underwrite on-orbit servicing at scale. Expect bespoke clauses for RPO, docking and third-party liability to harden.

Law and liability: it’s not maritime salvage

In space, there’s no “finders keepers.” Under the Outer Space Treaty (Art. VIII), the U.S. retains ownership, jurisdiction, and control over Swift regardless of altitude or who touches it. Any damage “elsewhere than on the surface of the Earth” triggers the Liability Convention’s fault-based regime between the relevant launching states. Translation: NASA’s consent (via this contract) is essential; NASA and the U.S. remain on the legal hook to other states if something goes wrong.

Regulatory plumbing matters, too. A U.S. servicer doing RPO will need FAA payload determination and launch licensing, FCC spectrum authorisations for TT&C, and may need a NOAA remote-sensing licence if its cameras image other space objects (which U.S. rules now handle with fewer restrictions but still require permissions). Those check-boxes often dictate schedule more than hardware.

Science dividend: Swift is still the world’s fastest GRB “dispatcher”

Swift routinely localises ~100 gamma-ray bursts per year, slewing within seconds to hand off coordinates across the global astronomy network. It passed 1,000 GRB detections years ago and, two decades on, remains central to time-domain astrophysics. Extending its life preserves a unique, low-latency “alerting” function while the community debates successors.

The missed angle: SBIR Phase III as an industrial policy tool

The quiet revolution here isn’t the robot hand; it’s the contracting model. By moving Swift through a Phase III SBIR, NASA has effectively shown how to turn prior small-business R&D into a non-competitive, fast-track operational buy—precisely the kind of approach critics wanted after OSAM-1’s cancellation. If this mission hits its marks, expect similar “rescue-as-a-service” buys for other aging but valuable government satellites.

What to watch between now and spring 2026

- Capture interface & load cases. Look for NASA/Katalyst to publish analyses showing acceptable shock/vibration margins on Swift’s instrument decks and solar panels during docking and push.

- Licensing milestones. FAA payload determination docketed, FCC filings for TT&C frequencies, and any NOAA licensing notes about on-orbit imaging of Swift. Delays here can slip a spring window.

- Ride selection & launch date certainty. The Reuters target is May 2026; watch the manifest of likely launch providers and rideshare windows.

- Playbook transfer. If the grip-and-boost method works on Swift’s flanges, can it generalise to other “unprepared” buses—Earth-science spacecraft, weather sats, even smallsats that lost control? NASA’s earlier concept studies with Cambrian and others hinted at a broader pipeline.

Swift, at a glance

- Launched: 2004 (Low-Earth orbit)

- Mission: Rapid detection/localisation of gamma-ray bursts; follow-up in X-ray and UV/optical

- Instruments: BAT (15–150 keV), XRT, UVOT

- Operations: ~100 GRBs/year; >1,000 historical detections

- 2024 status: Software patch enabled two-gyro operations after safe-mode event

- Orbit issue: Elevated drag during current solar max accelerated decay; targeted boost in spring 2026 via Katalyst servicer

Bottom line

This is not just a save-the-telescope story. It’s a test of whether the U.S. can field responsive, low-cost on-orbit services when science, security or sustainability demand it—under a procurement model built for speed. If Swift’s rescue works, the template could spread fast.